Double Entry for Provision for Doubtful Debts

Example From the following transactions identify the accounts involved and classify them according to modern and traditional approaches of classification of accounts. Double entry bookkeeping part A 3.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Pass the necessary journal entries prepare the revaluation account and partners capital accounts and show the Balance Sheet after the admission of C.

. Business documents and books of prime entry. A provision can be created due to a number of factors. V Creditors were unrecorded to the extent of 1000.

7A provision for potential bad debts in accounts receivable is debited to which account. Petty cash book. Iv A provision for bad and doubtful debts is to be created at 5 of debtors.

Bad debt expense Wrong. 1480 for accrued income are be shown in the books. - The Debtors Ledger - The Creditors Ledger.

Carrying value of asset at the end of year 3 would be as follows. Alternatively while recoding the entry for depreciation incremental depreciation due to the revaluation ie. Double entry bookkeeping part B 5.

B Land and Building was found undervalued by 26000. Bad debts should be written off when accounts are made up ix. Inventory valuation and its impact on financial statements is also covered.

The other examples of provisions are. For example here is a debtors ledger with a number of individual. 1000 are prepaid for insurance.

8333 can be charged to the revaluation surplus account. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. Accruals and prepayments.

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April 2016 and their new profit-sharing ratio will be 2. The mootness of the case in relation to the WMCP FTAA led the undersigned ponente to state in his dissent to the Decision that there was no more justiciable controversy and the plea to nullify the Mining Law has become a virtual petition for declaratory relief26 The entry of the Chamber of Mines of the Philippines Inc however has put into. 6000 have been omitted be recorded in the books.

Guarantee product warranties Requirements for creating provision. A Goodwill of the firm was valued at 300000. Allowance for doubtful accounts Right.

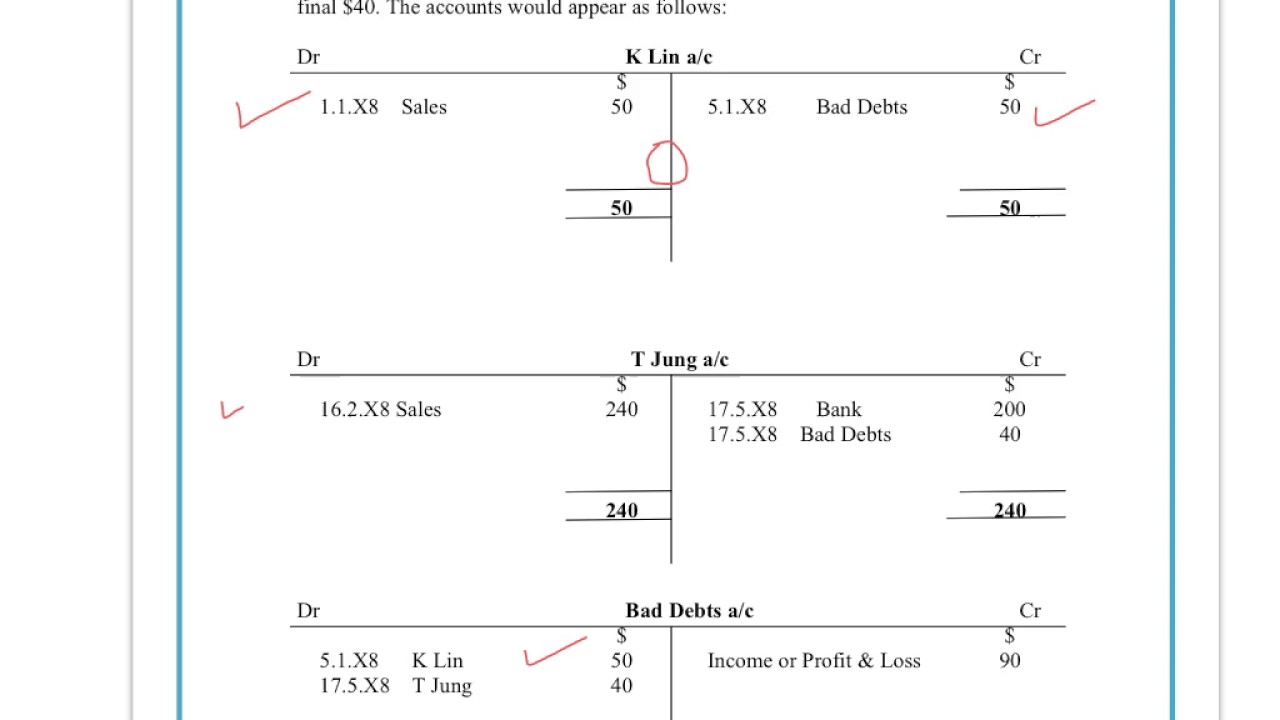

21 The System of Double Entry of Book-Keeping. Bad debts and provision for doubtful debts. The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an.

If a business along with its assets and liabilities is transferred by one owner to another the debt so transferred by one owner should be entitled to the same treatment in the hands of the successor. C Provision for doubtful debts was to be made equal to. He has worked as an accountant and consultant for more than 25.

As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. In balance sheet the balance in allowance for doubtful accounts is deducted from the total receivables to report them at their net realizable value or carrying value. Depreciation and disposal of fixed assets.

Allowance for doubtful accounts Wrong. The solution for this question is as follows. It is calculated to cover the cost of debts that are expected to remain unpaid during an accounting period.

5000 are outstanding for salaries. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. 5 provision be made for doubtful debts on Debtors and a provision of 2 be made on Debtors and Creditors for discount.

The Trial Balances. Treatments to record adjustments for accruals and prepayments bad debts provision of doubtful debts and bad debts recovered are included. Now lets assume that at the start of year 4 company identifies that value of asset has decreased to.

Outline the double entry system of book-keeping. Enter the email address you signed up with and well email you a reset link. If this occurs during the accounting year then the company can DIRECTLY write it off in the Income Statement otherwise a.

Gayatri brought 400000 as her capital and her share of goodwill premium in cash. Provision For Doubtful debts takes into consideration that when a company conducts it business there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad.

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Accounting Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

No comments for "Double Entry for Provision for Doubtful Debts"

Post a Comment